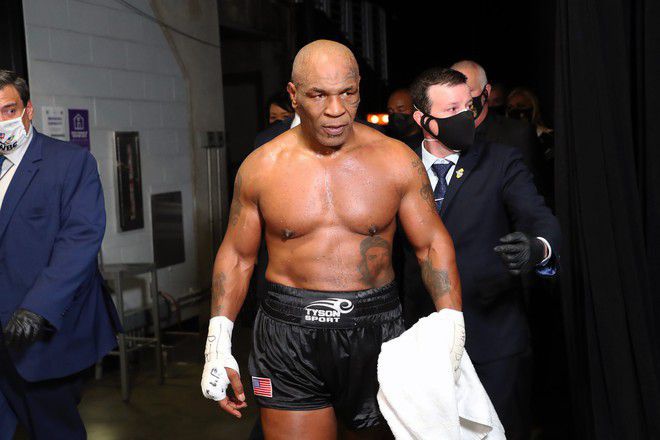

Mike Tyson, nicknamed “Iron Fist”, is the name that the whole world is talking about after the match between him and YouTuber Jake Paul ended at noon on November 16. This match is described as the most expensive of the year with 60 million USD (1,500 billion VND) – the remuneration for both.

Despite the failure, Tyson pocketed at least 20 million USD (~507 billion VND), thereby increasing the huge assets of this legendary American boxer. Known as one of the world’s top boxers, Mike Tyson was once considered a “money-making machine” during his peak years. However, in 2003, his name appeared frequently in the newspapers with headlines related to the story of bankruptcy. After more than 2 decades, how did this legendary boxer manage to overcome financial difficulties and regain his huge fortune at the age of U60?

Declare bankruptcy

Mike Tyson began his professional boxing career at the age of 18, after he knocked out opponent Hector Mercedes with a TKO in the first round.

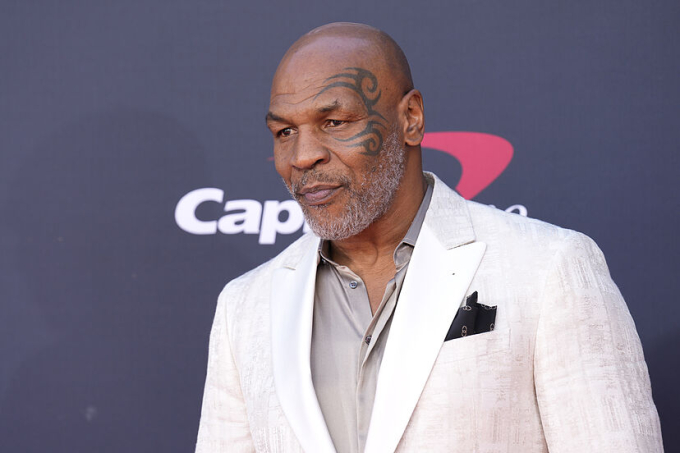

During his career, Mike Tyson achieved many remarkable achievements. He was ranked 16th in The Ring ‘s list of the 100 greatest punchers of all time and number one in ESPN’s list of the hardest punchers in heavyweight boxing history.

Despite the scandals in his personal life, Mike Tyson’s achievements in his fighting career alone are hard to beat. At his financial peak, Mike Tyson once put his net worth up to over $400 million (~10 trillion VND), making him one of the richest boxers to ever step into the ring. However, this figure only counts Mike Tyson’s income from professional sports activities, not taking into account other sources of income such as advertising profits and brand copyrights.

Unfortunately, Mike Tyson fell on hard times after retiring from professional boxing. After a series of mistakes, the champion was imprisoned, leading to many fans turning their backs on him and cutting off his advertising contracts. In 2003, Tyson declared bankruptcy with a debt of 23 million USD (~583 billion VND).

One of the reasons that pushed Mike Tyson to the brink of financial ruin was the champion’s extravagant spending habits. During the 1980s and 1990s, Tyson was known for his lavish lifestyle.

Mike Tyson’s biggest expense so far has been real estate. The boxing icon owns many million-dollar mansions across the US. Like many other stars, Mike Tyson also drives supercars. The Sun estimates that more than 100 cars worth hundreds of thousands of dollars have passed through the hands of the American boxer.

Besides, Mike Tyson also “burns” money on raising pets, hunting for luxury goods, partying all night long,… and many other pleasures of the upper class.

Despite the huge spending, the biggest blow to the legend’s net worth was undoubtedly the unhealthy partnership between Mike Tyson and the most powerful promoter in the world – Don King. Throughout Mike Tyson’s career, Don King is said to have defrauded and enriched himself by taking up to 50% of the boxer’s earnings. In addition, Don King listed his wife and children as advisors and various roles in Mike Tyson’s team, thereby withdrawing millions of US dollars annually for each person.

The Return of Mike Tyson

In a 2010 interview with The View, Mike Tyson opened up about his financial struggles, discussing how he struggled to pay his bills. He also admitted that he would do things differently if he could go back in time.

“If I could do it all over again, I would invest in real estate, buy apartments all over the world. Every year, I would go there to stay for a few days,” Mike said.

Fortunately, after two decades, Mike overcame bankruptcy and began to rebuild a strong financial foundation from various sources of income. He acted in movies, received appearance fees at events, and participated in exhibition fights. In addition, one of Tyson’s major breakthroughs was entering his own business.

According to Celebrity Net Worth , in 2020, Mike Tyson’s fortune was estimated at around $10 million (~253 billion VND). This is a fairly modest figure compared to the peak of his career. However, the boxing legend’s fortune has shown signs of strong growth, especially after his match with YouTuber and boxer Jake Paul.

Mike Tyson is no longer as lavish as before, focusing on his business projects and maintaining a healthy lifestyle. The strong financial recovery of this legend is a testament to his ability to reinvent himself, even after going through deep crises.

What can we learn from Mike Tyson’s financial crisis?

Not only Mike Tyson, many sports stars have gone bankrupt, even though at their peak they had a net worth of millions of dollars. Why is this situation not rare?

Most professional athletes earn their money in a short period of time, usually a few years. Then they start spending more than they can afford on luxuries. This can be a financial disaster for them. In addition, as an athlete’s net worth increases, financial advisors, friends, and relatives also try to take advantage of them and siphon money from them. Ultimately, many athletes lose money due to fraud and irresponsible financial management.

Pressure from friends and colleagues around them forces athletes to splurge on luxuries they cannot afford. In their short careers, they have to compete to earn money while also saving for the rest of their lives, and this requires discipline and hard work. Athletes who are careless with their finances, or who trust those around them with their money, can make mistakes that they cannot recover from later.

The stories of Mike Tyson in particular and other sports stars in general show that anyone can easily go from millionaire to poor. You can avoid this by saving money regularly, investing in the right assets to secure the future for yourself and your family.

Here are some lessons we can learn to move towards financial freedom:

– Plan your finances

Set monthly and yearly savings goals, no matter how good your income is. Also, set aside money for fixed investments every month. No matter how rich you are, if you just let your money sit idle for years, it will become “dead money” and cannot beat the rate of inflation.

In general, you need to stick to your financial plan, set aside some money for investment and savings before spending all the money in your bank account.

– Be careful when borrowing money

Avoid borrowing money to pay for luxuries you can’t afford. If your income suddenly drops, you may find it difficult to pay off your loans. So before you borrow money to buy a fancy car or house, think about whether you can still afford it.

– Start building your retirement fund early

Once you’ve grown accustomed to a lavish lifestyle, it can be difficult to adjust to a lower standard of living. That’s why building a retirement fund is essential. Start investing early to ensure that your retirement fund is large enough to support your lifestyle, even after you retire. If you start saving late, your retirement fund may not be large enough to support your desired lifestyle, but it’s too late to change.

– Don’t trust anyone with your money.

When it comes to money, even your closest relatives can deceive you to take your assets. Learn to manage your finances and protect your personal assets. Besides, it is better not to share too much about your personal finances, if you do not want to become a target of many bad guys.